Moody’s downgraded its outlook for the US sovereign credit rating to negative, sparking deep concerns in the market about the resilience of the global economic recovery. As the core driving force of commodity demand, the expected economic slowdown in the United States and the pressure of fiscal deficit have formed a dual suppression, resulting in significant short-term pressure on the copper and aluminum markets. Although the decline of the US dollar index has provided some support for prices, the intensification of supply-demand contradictions and the interweaving of policy uncertainty have significantly increased the volatility of metal prices.

Demand side: Resonance between infrastructure contraction and export obstruction.

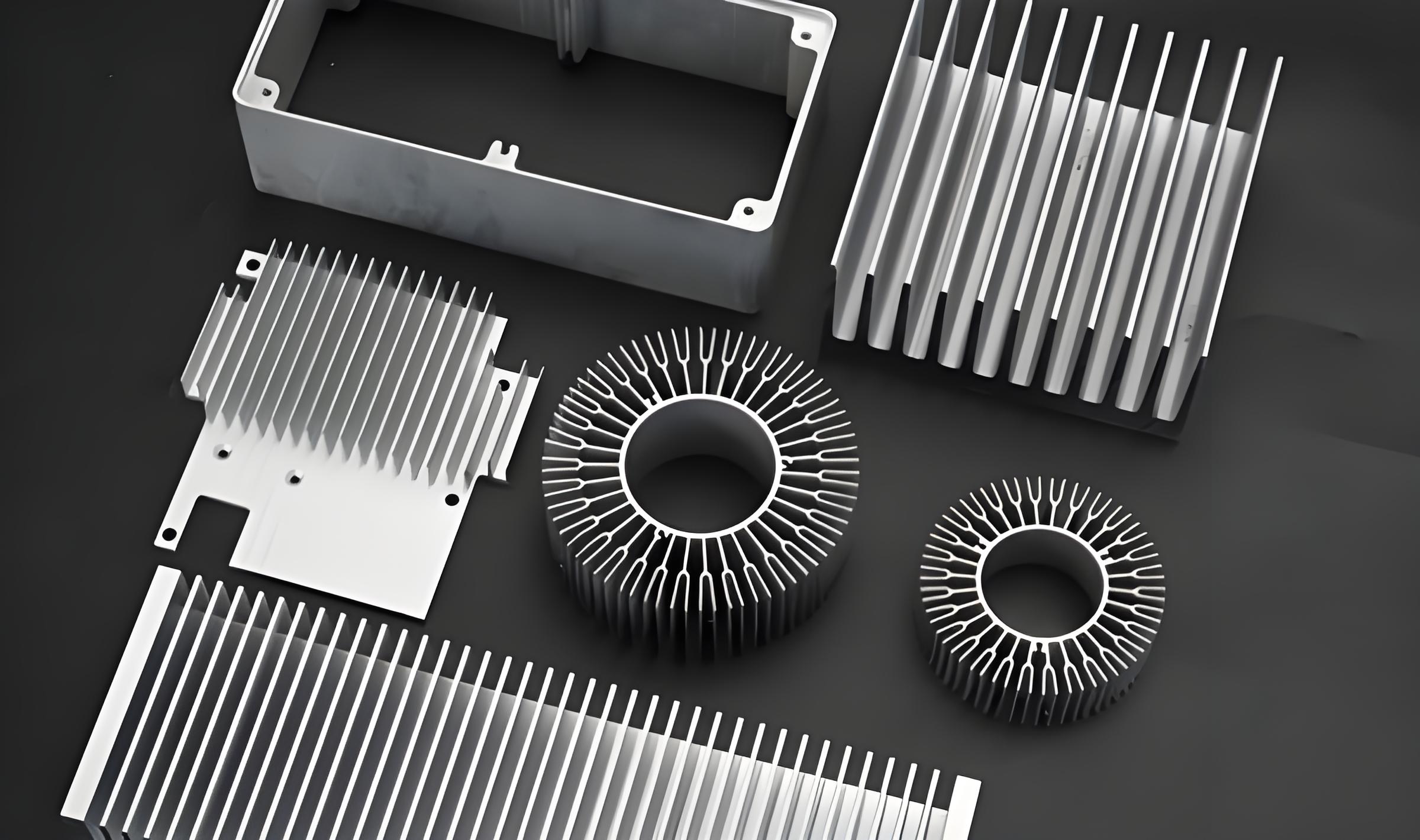

The downgrade of the US credit rating directly impacts infrastructure investment expectations, and the Trump administration’s originally planned $500 billion infrastructure bill may be forced to scale back, resulting in a reduction of copper demand for construction by 120000 to 150000 tons per year. At the same time, the tariff game between China and the United States continues to escalate, with rumors circulating that the US plans to impose a 25% tariff on imported copper and aluminum. This will raise the cost of domestic manufacturing in the United States and suppress the demand for imported processed products such as aluminum profiles and copper pipes. If EU countermeasures are implemented, the global aluminum trade flow may face restructuring, and China’s aluminum exports to Europe may face an additional tariff cost of 10%.

Supply side: The game between production reduction and resumption intensifies.

The supply side disturbance of copper mines continues, with Chile’s Codelco production declining by 18% year-on-year in the first quarter, and Peru’s Las Bambas copper mine reducing production by 30% due to community protests. However, the completion of domestic smelter maintenance has led to a 0.37% month on month increase in refined copper production in April. In terms of electrolytic aluminum, the resumption of hydropower in Yunnan has pushed the production capacity back to 43.64 million tons. However, the revocation of Guinea’s bauxite export license has raised concerns about raw material supply, causing alumina prices to skyrocket by 12% in a single day and cost support to move up to 17800 yuan/ton. It is worth noting that LME copper inventory has increased to 187000 tons, while aluminum inventory remains at a high level of 550000 tons. The implicit inventory pressure has not yet been fully released.

Cost and Policy: The Impact of Energy Transition on Pricing Logic

The global energy transition is accelerating and weakening the demand for traditional industrial metals. The upgrading of the EU carbon tariff mechanism has led to an 8-10% increase in aluminum smelting costs, and the growth rate of aluminum demand for photovoltaics may decrease from 25% to 15%. The increase in shale oil production in the United States has driven down energy costs, and the marginal cost center of electrolytic aluminum has been lowered to $2500/ton. However, tightening environmental policies may push up capital expenditures for overseas new construction projects. Domestically, the policy for the recycled metal industry has been strengthened, with the goal of increasing the proportion of recycled copper to 40% by 2025, which may reshape the global copper supply pattern in the long run.

Outlook for the future: Structural opportunities under rising volatility.

Short term copper prices may test support at 77500 yuan/ton, with Shanghai Aluminum’s main contract focusing on the 20000 yuan mark competition. If the US infrastructure stimulus policy falls short of expectations, the growth rate of copper demand in the third quarter may be revised down to 1.8%, and aluminum prices will face the risk of cost collapse of $2500-2600 per ton. Suggest paying attention to two major signals: 1) whether LME copper inventory has fallen below 150000 tons; 2) Is the expectation of the Federal Reserve cutting interest rates ahead of schedule due to deteriorating economic data. The industrial sector needs to be vigilant about the hedging risks posed by high inventory levels. Investors can pay attention to cross variety arbitrage opportunities and seize the window of copper aluminum price correction.

Conclusion: Anchoring Industrial Logic in Uncertainty.

The downgrade of ratings is essentially a microcosm of the failure of global economic governance, and the copper and aluminum market is undergoing a pricing paradigm shift from “demand resilience” to “cost collapse”. Investors need to break out of the short-term volatility trap, focus on the long-term trends of energy transformation and supply chain restructuring, and capture trading opportunities brought about by structural contradictions in the volatility.

Post time: May-23-2025