On August 25, 2025, the Semi Annual Report disclosed by Minfa Aluminum Industry showed that the company achieved a revenue of 775 million yuan in the first half of the year, a year-on-year decrease of 24.89%. The net profit attributable to shareholders of the listed company was only 2.9357 million yuan, a year-on-year decrease of 81.13%.

Reflects the survival pressure of aluminum processing enterprises under fluctuations in raw material prices, weak demand, and intensified industry competition.

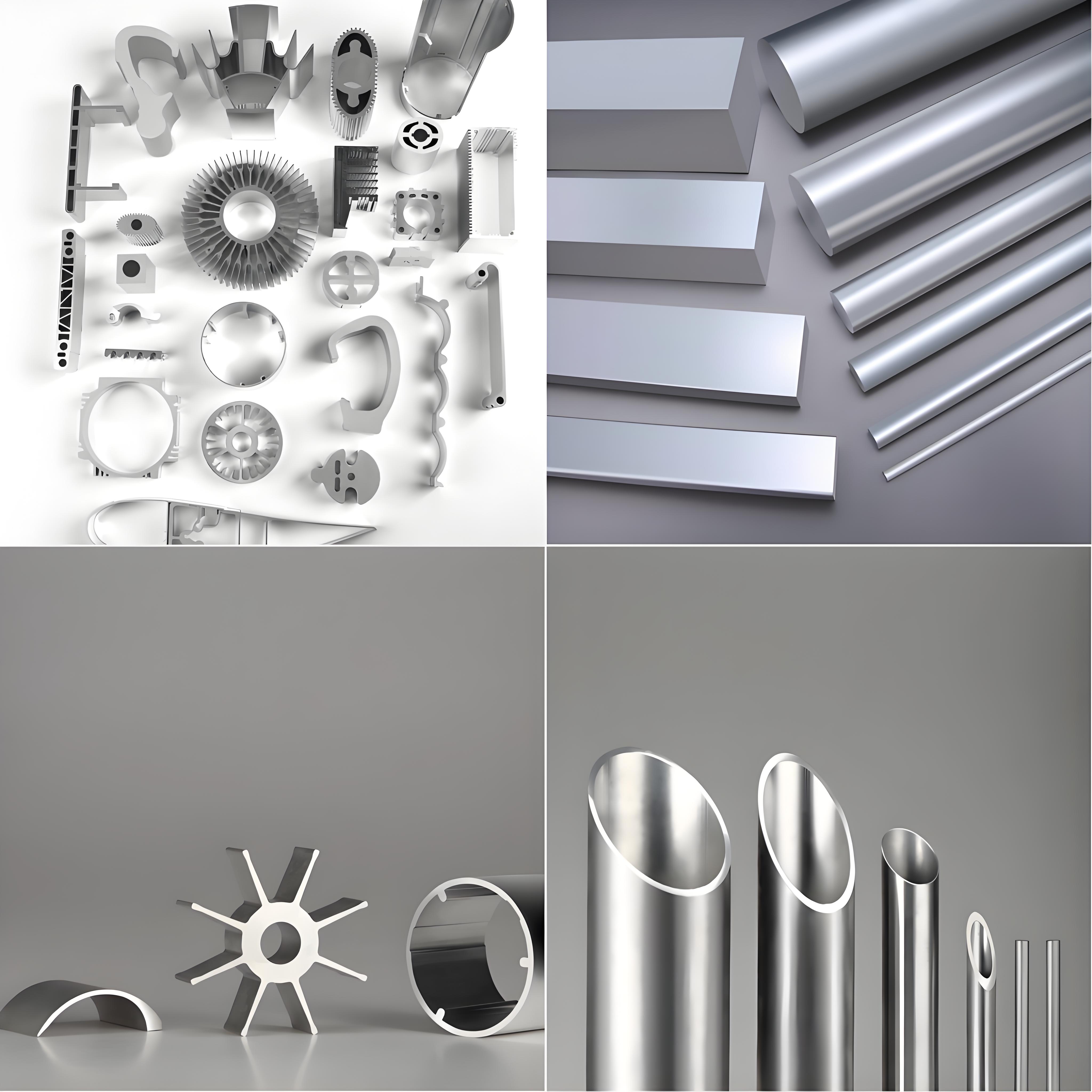

From an industry perspective, the aluminum processing industry is facing multiple challenges. On the one hand, the sustained downturn in the domestic real estate industry has dragged down the demand for construction aluminum profiles, while emerging fields such as new energy vehicles and photovoltaics have grown rapidly, but the increment is not enough to make up for the gap in the traditional market.

The dilemma of Minfa Aluminum Industry is representative of the industry.

The company admitted that the order volume of traditional construction aluminum decreased by 35% year-on-year, while industrial profiles increased by 18%. However, due to the technological route switching in areas such as photovoltaic frames and lightweight new energy vehicles, the proportion of high value-added products is insufficient, and the gross profit margin is under pressure.

Market analysis indicates that the clearance and integration of the aluminum processing industry are imminent.

According to the data of China Nonferrous Metals Industry Association, from January to July 2025, the industry’s fixed assets investment decreased by 21% year on year, and the capacity utilization rate of small and medium-sized manufacturers was less than 50%.

At the policy level, the Ministry of Industry and Information Technology recently released the “Work Plan for Stabilizing Growth in the Aluminum Industry”, which proposes to strive to exceed 6.5 million tons of aluminum exports by 2025, with a focus on supporting the research and development of aluminum materials for aerospace and rail transit. This is beneficial for companies with technological reserves, but for manufacturers such as Minfa Aluminum that rely on traditional products, the window for transformation is narrowing.

Industry experts suggest that small and medium-sized aluminum processing enterprises can break through in three directions: first, they can deeply cultivate niche fields, such as high growth tracks such as microchannel flat tubes and battery foils in automotive lightweighting; Secondly, strengthen technical collaboration with downstream customers and enhance customized service capabilities; The third is to use futures tools to hedge price risks and optimize inventory management.

Minfa Aluminum mentioned in its semi annual report that it will promote a “differentiated product strategy”, but whether it can reverse the trend remains to be tested by the market.

Currently, the aluminum processing industry is going through a reshuffle period of “the leftovers are king”. With the promotion of the “dual carbon” target and the increase in the proportion of recycled aluminum applications, enterprises with green manufacturing capabilities may receive policy support. For Minfa Aluminum, how to balance survival and transformation during the industry’s painful period will be a key proposition for its future development.

Post time: Aug-27-2025