The London Metal Exchange (LME) aluminum inventory continues to bottom out, dropping to 322000 tons as of June 17, hitting a new low since 2022 and a sharp decline of 75% from the peak two years ago. Behind this data is a deep game of supply and demand pattern in the aluminum market: the spot premium for three-month aluminum has shifted from a $42/ton discount in April to a premium, and the overnight extension cost has soared to $12.3/ton, reflecting the pressure of long positions to squeeze positions.

Inventory crisis: liquidity depletion intertwined with geopolitical games

Since June, only 150 tons of warehouse receipts have been registered for LME aluminum inventory, and two-thirds of the existing inventory is Russian aluminum that has been banned by the US and UK. China accelerated the absorption of 741000 tons of Russian aluminum from January to April, a year-on-year increase of 48%. However, domestic electrolytic aluminum production capacity has approached the policy ceiling of 45 million tons, and the inventory of the previous period has synchronously dropped to a 16 month low. Under the pressure of supply and demand, the liquidity of the aluminum market is showing a “double kill” trend.

Trade Restructuring: Hidden Variables in the Flow of Waste Aluminum

The global trade pattern of scrap aluminum is undergoing a dramatic change: the United States is using tariff exemptions to attract the return of scrap aluminum, which is impacting the layout of China’s recycled aluminum industry. Data shows that China’s recycled aluminum production will reach 10.5 million tons in 2024, accounting for 20% of the total aluminum supply. However, the tightening import restrictions in Southeast Asian countries have forced Chinese companies to set up factories in Malaysia and Thailand to process low-quality waste. At the same time, the European Union is promoting self-sufficiency in scrap aluminum recycling, and Japan’s proportion of recycled aluminum has reached 100%. The global competition for low-carbon aluminum is becoming increasingly fierce.

Industry transformation: parallel high-end demand and policy constraints

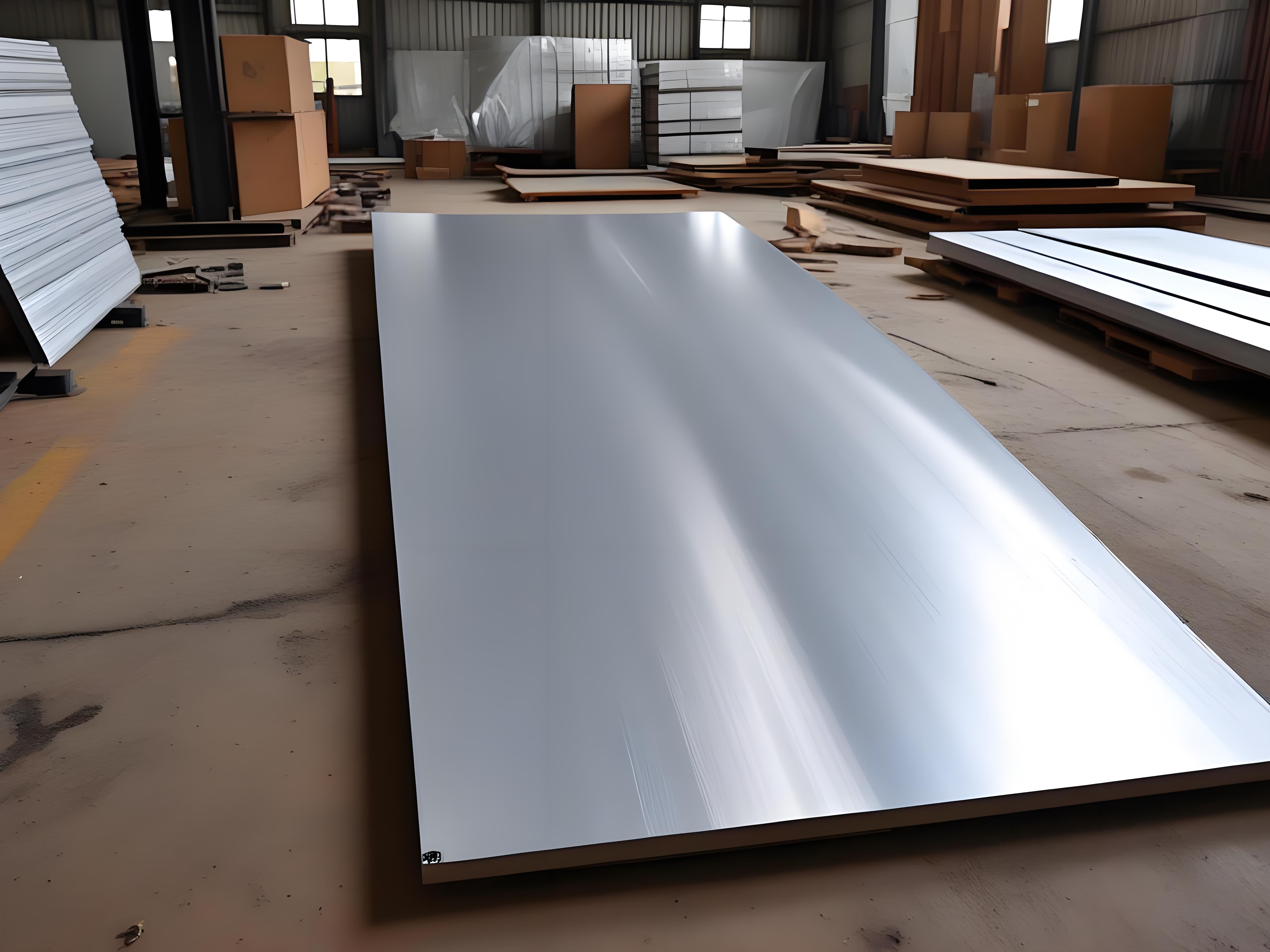

The structural transformation of China Aluminum Industry is accelerating: In 2024, the proportion of high value-added products such as aviation aluminum plates and power battery foils in the aluminum production of 42 million tons will increase to 35%. The proportion of aluminum used in new energy vehicles has jumped from 3% in 2020 to 12%, becoming the core engine of demand growth. However, the external dependence of bauxite exceeds 70%, the capacity ceiling of electrolytic aluminum is limited, and coupled with the pressure of the EU Carbon Border Tax (CBAM), the expansion of the industry faces multidimensional constraints.

Future outlook: Structural challenges in the era of low inventory

Analysis suggests that the current LME aluminum squeeze behavior has surpassed short-term speculation and evolved into a stress test for the resilience of the global aluminum supply chain. If the low inventory state persists, the market may shift from “cyclical surplus” to “structural shortage”. Enterprises need to be alert to the composite impact of geopolitical risks, trade policy changes, and capacity constraints, and breakthroughs in recycled aluminum technology and localization of high-end materials may become the key to breaking through.

Post time: Jun-26-2025